- Navigator

- Expansion Solutions

- Agriculture and Forestry

- Manufacturing

- Industry Analytics and Strategy

- National

This article originally appeared in the July 2025 issue of Expansion Solutions magazine.

Key Takeaways

This section is AI-generated and then edited by staff. The rest of the article is not AI-generated.

- The US Food and Beverage sector is evolving due to changing consumer preferences, new technologies, and a focus on building resilient supply chains.

- The beverage industry is experiencing significant growth, driven by flavored malt beverages and hard seltzers, with breweries accounting for a large share of employment.

- There is a strong trend towards eco-friendly packaging, with companies investing in sustainable packaging innovations to meet consumer and regulatory demands.

- The rise of health-conscious and functional beverages, such as non-alcoholic and gut-health-oriented drinks, is reshaping the market.

- Local food systems are gaining traction as a response to supply chain disruptions, with investments in local food infrastructure and shorter supply chains.

In the last several years, Camoin Associates has worked on a wide variety of food and agribusiness projects across the US, gaining insight into factors impacting the industry and the related programs and policies that support the sector. The industry’s evolution is being fueled by the latest consumer preferences, new technologies, and a growing interest in building more resilient supply chains.

Growth in the beverage sector, along with a broader shift toward local food systems and investment in logistics infrastructure, continues to reshape the landscape. These trends are creating new opportunities for communities, small producers, and supply chain partners while also raising important questions about how to support the industry’s continued success.

Consumer Trends in the Beverage Industry

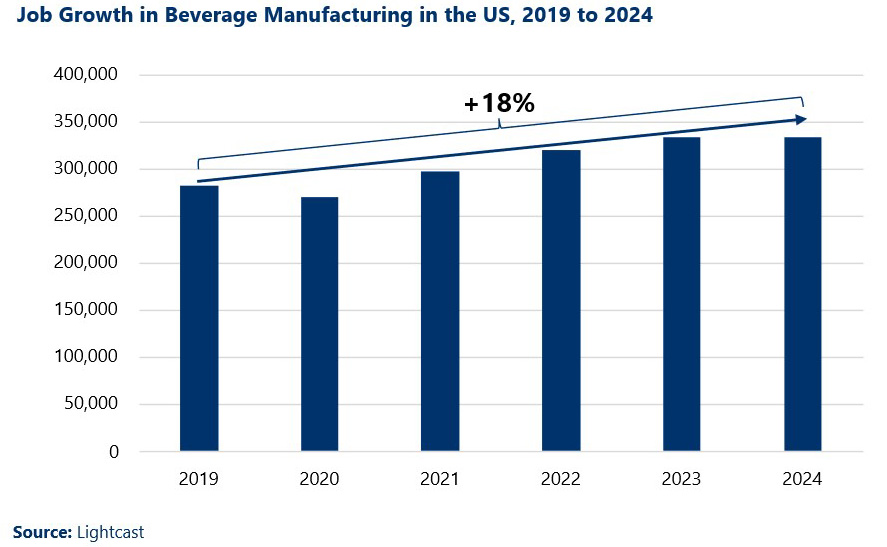

The beverage industry is booming. In the last five years, Beverage Manufacturing added more jobs than any other food and beverage manufacturing subsector in the US, growing by almost 52,000 jobs, an increase of 18%. To put that figure in perspective, the next-fastest growing industry was Bakeries and Tortilla Manufacturing, which added about 36,000 jobs (Source: Lightcast).

Breweries currently make up the largest share of the beverage industry, accounting for about one-third of all employment in Beverage Manufacturing in 2024 and growing by nearly 24,000 jobs in the last five years.

According to IBISWorld, the sector’s growth is driven by flavored malt and beverages like hard seltzers, which appeal to younger consumers. The industry is characterized by heavy competition, which creates a difficult market for both existing producers and new businesses because continual innovation is critical to maintaining interest and remaining relevant in the market.

According to IBISWorld, the sector’s growth is driven by flavored malt and beverages like hard seltzers, which appeal to younger consumers. The industry is characterized by heavy competition, which creates a difficult market for both existing producers and new businesses because continual innovation is critical to maintaining interest and remaining relevant in the market.

The industry is undergoing a significant transformation, driven by consumer demand for sustainability, health-conscious products, and evolving social norms. These shifts present opportunities and considerations for economic developers and industry stakeholders looking to support growth and innovation within the sector.

A leading trend is the widespread adoption of eco-friendly packaging. As environmental concerns become more central to consumer decision-making, beverage companies are rethinking their approach to packaging. From compostable materials to recyclable alternatives and reduced plastic usage, businesses are investing in sustainable packaging innovations that align with shifting regulatory frameworks and public expectations.

A leading trend is the widespread adoption of eco-friendly packaging. As environmental concerns become more central to consumer decision-making, beverage companies are rethinking their approach to packaging. From compostable materials to recyclable alternatives and reduced plastic usage, businesses are investing in sustainable packaging innovations that align with shifting regulatory frameworks and public expectations.

This trend creates openings for local manufacturing, materials innovation, and recycling infrastructure development. For example, the Coca-Cola Company, Keurig Dr Pepper, and PepsiCo have implemented the “Every Bottle Back” initiative to focus on creating a circular economy. Companies implementing the “Every Bottle Back” initiative are creating 100% recyclable plastic bottles and focusing on limiting the use of new plastic in bottles.

Simultaneously, there is a growing emphasis on health, wellness, and alternative beverage options. Consumers—particularly younger generations—are looking for products that support healthier lifestyles, better sleep, and fewer hangovers. This demand is reshaping the product landscape.

Non-alcoholic beverages are no longer niche but are entering the mainstream, with a surge in offerings from companies like Athletic Brewing Co., Do Soi, and Curious Elixirs. These brands capture market share by catering to a demographic that values moderation without sacrificing flavor or experience.

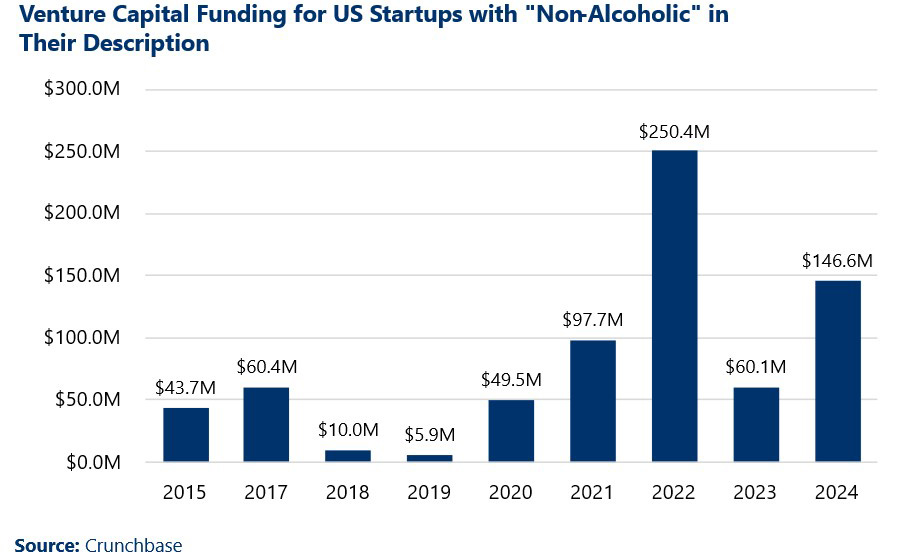

The momentum behind non-alcoholic beverages is best demonstrated by venture capital (VC) funding for these brands in the last decade. In the three years from 2022-2024, the total reported VC funding for startups with “non-alcoholic” in their descriptions was over $457 million, compared to $267 million in the six years from 2015-2021.

Another critical shift is the rise of functional beverages. These beverages incorporate ingredients such as prebiotics, probiotics, vitamins, and electrolytes to support hydration and overall wellness. PepsiCo’s acquisition of Poppi in March 2025 was a major milestone in this space, demonstrating strong market confidence in gut-health-oriented beverages.

Other brands like Liquid IV and Liquid Death are gaining ground through strong positioning at the intersection of health and lifestyle branding. Influential voices, such as celebrities creating their own beverage lines, are shaping consumer perceptions and fueling demand through targeted media and digital platforms.

Shift to Local Foods

Over the past five years, the United States has faced significant disruptions in its food supply chains, exposing vulnerabilities in the way food is produced, distributed, and consumed.

Major global events, such as the COVID-19 pandemic and the Russian invasion of Ukraine, have triggered widespread supply chain shocks, leading to food shortages, price volatility, and logistical bottlenecks. These disruptions have highlighted the fragility of the global food system and the need to improve supply chain resiliency.

In response, there has been growing enthusiasm for strengthening local and regional food systems. By reducing dependence on long, complex supply chains, locally sourced food often provides more stable access to fresh produce, dairy, and meat products, even during supply shocks. Shorter supply chains also help mitigate risks associated with transportation disruptions, trade restrictions, and global commodity price fluctuations.

As a result, both policymakers and industry leaders are increasingly advocating for investments in local food infrastructure, such as regional distribution hubs and cooperatives, and the development of local and regional food brands and marketing campaigns.

Beyond concerns about resilience, a broader shift in consumer and institutional preferences has fueled the movement toward local food sourcing. Many consumers prioritize sustainability, seeking food grown using environmentally friendly practices with a lower carbon footprint.

Meanwhile, institutions such as schools and hospitals are also incorporating more locally sourced foods into their procurement strategies.

Institutions can play a major role in creating a new market for small-scale producers, allowing them to directly market to wholesale customers rather than navigate the complex, expensive process of creating retail market relationships and marketing to consumers. For example, the PA Beef to PA Schools program connects Pennsylvania beef producers to Pennsylvania school districts, which, in the 2022-2023 school year, connected over 6,400 pounds of local beef to schools across five counties.

Rural and Small-Scale Distribution

How do rural areas compete in food and beverage manufacturing and distribution? Rural areas face distinct challenges in distributing goods and scaling operations, particularly for small and mid-sized producers who often lack the infrastructure, market access, and support needed to grow. However, countless case studies from across the country highlight how collaborative models—many driven by nonprofits and regional partnerships—effectively address these barriers and enable rural producers to compete in broader markets.

One of the most effective strategies is the development of shared-use infrastructure. In regions where capital investment is a significant hurdle, facilities such as commercial kitchens, storage spaces, and processing centers are made available to multiple producers. This approach lowers overhead costs and allows businesses to scale without requiring substantial upfront investment.

Another key factor is the creation of aggregation and distribution networks. Small producers in rural areas typically operate at volumes too low to reach institutional or retail markets on their own. These models facilitate access to larger markets by pooling products through centralized hubs. In addition, they offer flexible, cost-effective distribution solutions that make logistics feasible for lower-volume producers.

Business support services also play a critical role. Many rural producers benefit from targeted advice, technical assistance, and product development support that help them improve quality, meet regulatory requirements, and grow strategically. These services are often tailored to the unique needs of rural enterprises, ensuring they are both practical and impactful.

Logistics, Distribution, and Transportation for the Food and Beverage Industry

As supply networks for food and beverages become more complex and the industry faces increased competition, the logistics side of the industry has become increasingly critical to the sector’s growth.

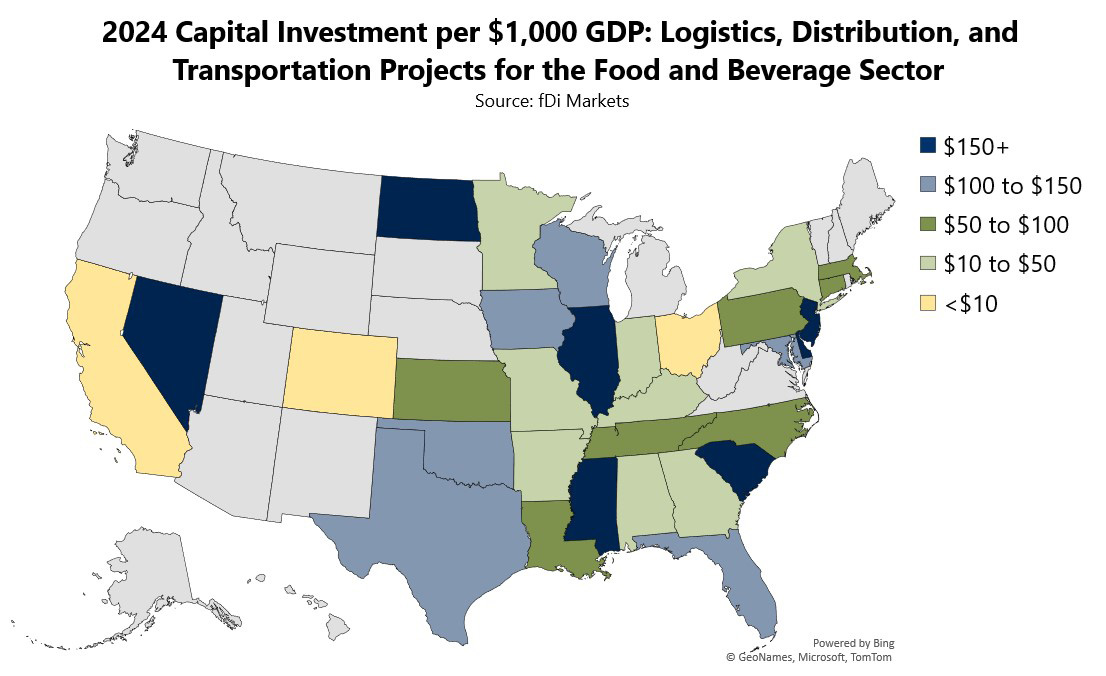

From 2014-2024, the fDI Markets Database tracked 531 cross-border investment projects related to logistics, distribution, and transportation for the Food and Beverage industry, totaling an estimated $33.6 billion in investment. Texas attracted the most investment, with $441 million of capital expenditures across 51 projects.

Investment in Food and Beverage logistics is critical for ensuring a resilient domestic food supply chain and is a strong indication of the system’s modernization. Take, for example, Walmart’s three-pronged approach to making transformative modernization investments in its grocery network:

- Building five new high-tech perishable distribution centers (DCs)

- Expanding four existing DCs to add 500,000 square feet (SF) of automation per site

- Retrofitting one DC with high technology integration as a pilot to determine how best to retrofit others

These investments are taking place across the country in California, Texas, South Carolina, Illinois, New Jersey, Minnesota, North Carolina, Indiana, Tennessee, and Florida.

According to the fDi Markets database (from the Financial Times Ltd, 2025), $3.4 billion of cross-border capital was invested in logistics, distribution, and transportation projects for the Food and Beverage industry in 2024 alone. Adjusting for gross domestic product (GDP), states like North Dakota, Delaware, South Carolina, and Illinois saw the most momentum from these investments in 2024. Meanwhile, another $1.5 billion was invested in cross-border projects that include cold storage or refrigerated shipping.

Other key projects in the last year include:

- November 2024: Minnesota-based CHS, a farmer-owned cooperative, will expand and upgrade its grain terminal in Kindred, NC. Upon completion, the facility will support a capacity of 5.2 million bushels. The facility has on-site rail access that connects it to new and existing grain processing plants in North Dakota.

- September 2024: Georgia-based Americold announced it will expand its cold storage warehouse in Fort Worth, TX, investing $123 million in the project.

- February 2024: Chick-fil-A announces it has opened a new distribution facility in Hutchins, TX, representing $100 million of investment and spanning nearly 290,000 SF of space. The major distribution facility will service 200 restaurants in the region.

Implications for Economic Development

Implications for Economic Development

The beverage industry’s rapid growth, particularly in health-conscious, functional, and sustainable product lines, offers significant opportunities for economic developers to support innovation, attract investment, and create quality jobs.

Shifting consumer preferences are driving demand for alternative beverages, eco-friendly packaging, and wellness-oriented ingredients and fueling growth in advanced manufacturing, research partnerships, and circular economy initiatives.

Communities that invest in adaptable infrastructure, research and product development capacity (R&D), and talent pipelines in food science and packaging technology will be better positioned to support business attraction and expansion in a competitive market.

At the same time, the movement toward local food systems and supply chain resilience is opening new pathways for rural and regional economic development. Shared-use infrastructure, aggregation and distribution networks, and institutional procurement create more inclusive market access for small and medium-sized producers.

Coupled with large-scale investment in logistics and distribution facilities, there is a growing need for transportation improvements, workforce training, and coordinated support services.

Economic developers have a critical role to play in aligning local assets with these evolving industry dynamics to strengthen food system resilience, spur rural innovation, and build long-term regional competitiveness.

Camoin Associates is a trusted economic development and business prospecting consulting firm that helps communities and organizations achieve sustainable and equitable growth through expert analysis, effective strategies, and intentional connections.

By providing valuable insights, best-in-class data, and personalized, actionable strategies, we empower our clients to make well-informed decisions that drive economic success and foster strong, competitive markets.

Learn more about our Industry Analytics and Strategy services

📍 Related Articles:

- US Food and Beverage Production Sector Trends

- Changing Consumer Trends Drive Increased Investment in Alternative Proteins and Plant-Based Foods Industry

About the Authors

Victoria “Tori” Conroy is a Senior Project Manager at Camoin Associates. She has a Master of Public Administration degree and a graduate certificate in local government management from Virginia Tech, as well as a B.A. in Political Science from Virginia Commonwealth University. Before coming to Camoin Associates, Tori worked for several different economic development authorities and has experience managing publicly owned industrial properties, building community partnerships to support workforce development, and developing and executing business retention and expansion programs. Tori has also led and implemented business attraction campaigns nationally and abroad.

Angela Hallowell is a Senior Economic Data and Research Analyst at Camoin Associates. She holds Master of Science and Bachelor of Science degrees in Economics from the University of Maine. Angela’s work spans diverse topics across the country, including economic and fiscal impact studies, real estate market analyses, workforce gap assessments, housing needs studies, and targeted industry strategies. She is passionate about leveraging data and research to craft compelling narratives that create economically healthy, vibrant, and sustainable communities.

![US Foreign Direct Investment (FDI) 2025 Mid-Year Trends [Infographic]](jpg/web-header-900x600.jpg)